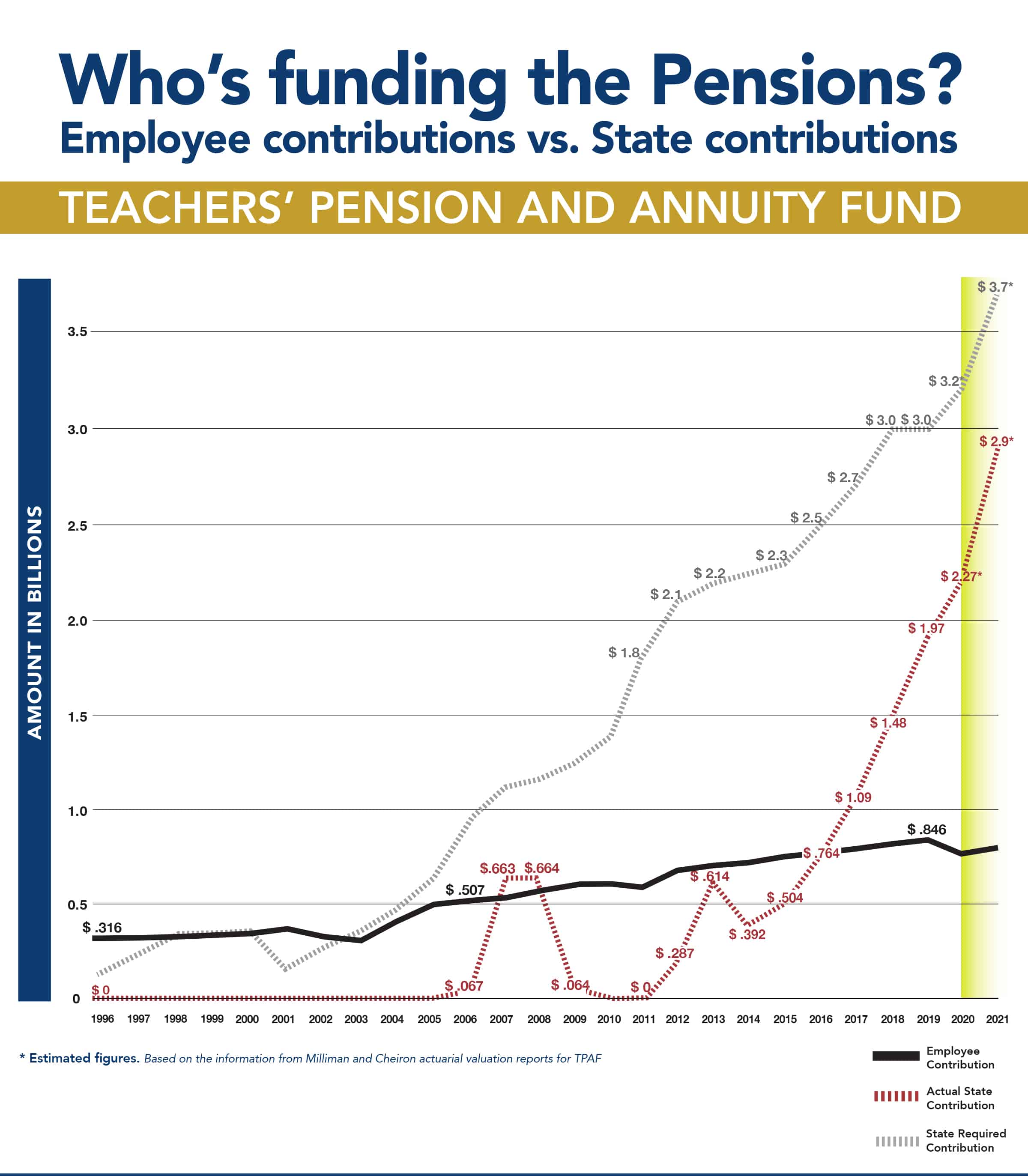

In this graph, the black line shows how much public school employees in the Teachers’ Pension and Annuity Fund (TPAF) have been contributing to the fund since 1996. The gray line shows what the state’s required contributions should have been based on the actuarial valuation reports. The red line shows the state’s actual contribution to the fund in the same years.

In this graph, the black line shows how much public school employees in the Teachers’ Pension and Annuity Fund (TPAF) have been contributing to the fund since 1996. The gray line shows what the state’s required contributions should have been based on the actuarial valuation reports. The red line shows the state’s actual contribution to the fund in the same years.

Because public employees in the TPAF have always made their full contribution to the pension system, that line steadily increases over time. In contrast, the state has not been making the full payment although in recent years the contributions have sharply increased.

Under P.L. 2011, Ch.78, the Christie administration committed to increasing the state’s payments over a seven-year period. In Year 7, the full payment would be made. For three years, the state adhered to the payment schedule, but in Fiscal Year (FY) 2015, the Christie administration failed to include the four-sevenths pension payment. NJEA filed a lawsuit along with other public-employee unions. The New Jersey Supreme Court ultimately ruled in favor of the state, holding that the state’s pension payments per Ch.78 violated the debt limitation clause of the New Jersey Constitution.

The Murphy administration has been committed to funding the pension system and has consistently increased the state’s contribution to the pension system. The current trajectory for ramping up to the state’s full payment is to increase the payment by tenths each year

In the 2020-21 fiscal year, the state budget includes eight-tenths payment. By fiscal year 2023, the state is finally expected to make the full pension contribution—also known as 100% of the Annual Required Contribution (ARC) as determined by the plan’s actuaries.