By the NJEA Pension Policy Committee

New Jersey’s public pension systems have often been highlighted in the news as being severely underfunded year after year. Unlike many governors before him, Gov. Phil Murphy has kept his promise to public employees to begin making the full pension payment, setting up the system for a more stable future. This is good news for both retired and active members of a state pension system, particularly since participants have never missed a payment.

You probably have heard that New Jersey has recently made a historic payment to the pension system. In New Jersey’s fiscal year 2022 budget, Murphy includes a $6.9 billion payment to the state-sponsored pension systems—that’s out of a total $44.8 billion budget. The $6.9 billion payment is the full amount required per the actuaries of the state pension systems plus an additional $505 million. On July 1, the state put $5.8 billion into the state pension systems. The remaining $1.1 billion will come from lottery proceeds, which are paid into the pension monthly.

What’s the big deal about a pension anyway? Why should you care about it? Why is it better than retirement savings accounts, such as a 401(k) or 403(b)? This article will address these questions to illustrate why NJEA and other public-sector unions have fought so hard for the state to uphold its end of the bargain when it comes to pension funding. The two retirement vehicles function very differently and those differences affect how you should plan for retirement.

How a defined-benefit pension works

A defined-benefit pension is an employer-sponsored account that provides the pensioner with an annual benefit in retirement based on a predetermined calculation consisting of your salary and years of experience. Both you and the employer (the state or the school district) pay a set amount toward the pension while you are actively working. If you are in a job that is part of a pension system, you cannot choose whether or not to participate/contribute—your employer must enroll you and withhold your contribution from your paycheck.

If you are a certificated employee in a pension-eligible position, you are a member of the Teachers’ Pension and Annuity Fund (TPAF), one of the state funded systems. If you are an educational support professional, such as a paraprofessional, custodian, school secretary, bus driver or other support staff position, employed in a pension-eligible position, you are in the Public Employees’ Retirement System (PERS), and your local school district contributes to your pension. Some higher education employees participate in the Alternate Benefit Program.

The New Jersey Division of Investment (DOI) invests the employee and employer contributions for both TPAF and PERS members. By pooling all pension contributions together, DOI can customize the investment portfolio to maximize investment returns while maintaining the liquidity necessary for those already drawing pensions. According to research conducted by the National Institute for Retirement Security, the vast majority of the pension benefit retirees receive is from investment earnings.

How a 401(k)/403(b) works

A 401(k) or 403(b) is a tax-deferred, individually owned account used to save for retirement. What follows in this section applies to both 401(k) and 403(b) accounts. Because, public-sector education employees typically have the option to contribute to a 403(b) while private-sector employees would contribute to a 401(k), the remainder of this section will reference 403(b) accounts.

When you have a 403(b) account, you typically will contribute into an account that you own. Although employers can contribute to 403(b) accounts, typically this account will contain only employee contributions. Since you are the account owner, you decide how to invest the money, and typically you can choose between various index funds, stocks, etc. You choose how aggressively or conservatively you want the money invested. Also, there are fees that you pay to invest your money, and those fees vary based on the 403(b) vendor.

At the time you retire, you must decide what to do with the money you have in the account. You can opt to turn the amount or part of the amount into an annuity, or just draw down from the lump sum amount.

Comparison of defined benefit and defined contribution retirement plans

| Defined Benefit – Pension | Defined Contribution – 401k/403b | |

| How much do you contribute? | Required % of salary | Whatever amount you choose |

| What determines payouts? | How long you work and your salary | How much you and your employer contribute and the investment earnings |

| Who makes investment decisions? | Investment professionals with the N.J. Division of Investment | You |

| How long will you receive payments? | Lifetime | Until the account is depleted |

What makes a pension preferable to a 403(b)?

A defined-benefit pension is preferable to an individual retirement account such as a 403(b) in terms of planning, efficiency and investment strategy. If your retirement were solely based on a 403(b), there are many unknowns that can make it difficult to plan for retirement, such as stock market downturns and how long you expect to live in retirement. With a pension, you can retire regardless of the current state of the economy since your monthly payment is based on a predetermined formula. Does longevity run in your family? Rest assured you will receive your pension for as long as you live into retirement, even if it is several decades. While a 403(b) is certainly good to have in addition to a defined benefit pension, it is not a replacement for having a guaranteed lifetime payment.

Since there are many participants in the system who are not eligible yet for retirement, this allows investment professionals to create a diverse portfolio with short and long-term investments, maximizing potential returns. For example, the pension fund system can maintain high-risk, high-reward investments because it does not have to have the money to pay out all retirement benefits at any given time. If you maintain high-risk investments close to retirement in an individual retirement account, you run the risk of not having enough money to retire.

Finally, with an individual investment account, you are responsible for your own investment decisions, so you must pick where you are invested and how conservative or aggressive those investments are. You can choose to invest in target retirement date funds, but these funds can have high expense ratios, meaning a chunk of your investment goes to fees. The New Jersey Division of Investment manages pension money at a relatively low cost—at 0.4% of the total fund (Source: N.J. State Investment Council Annual Report 2020).

Who’s funding the pensions

Every time you receive payment from your school district, a portion of your earnings is remitted to the pension system. Currently, members of the pension system contribute 7.5% of base salary (any extracurricular or other temporary pay is not included). The amount members contribute has changed over the years, with the most recent change commencing in 2011 with the passage of P.L.2010, Ch. 78. Prior to the passage of Ch. 78, K-12 members of the pension system contributed 5.5% of salary. Ch.78 immediately increased the member payment to the pension from 5.5% to 6.5% of salary and phased in the additional percent over seven years.

The increase in member contributions to the pension system is primarily due to the state not paying its share of the contribution year after year. When a pension system is not properly funded, plan liabilities grow, ballooning the cost to keep the system afloat. Imagine if you only made the minimum payment on your credit card month after month. Eventually the payment would become so large it would be unsustainable.

The increase in member contributions was supposed to be commensurate with the state ramping up its payments. However, in the 2014 fiscal year, the Christie administration announced that the state would not make the full payment due to budget constraints.

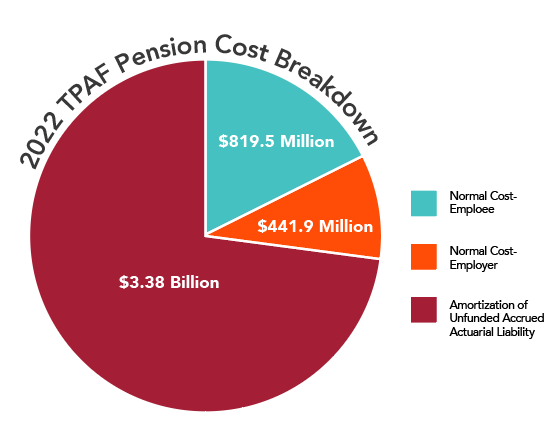

The chart titled 2022 TPAF Pension Cost Breakdown illustrates the cost of funding the TPAF, the fund that includes all certificated K-12 members. The information comes from the 2020 Pension Fund Valuation, which is an annual report summarizing the financials of the pension fund.

The normal cost is the amount of money it costs for all active members to earn an additional year of credit in the system. The total normal cost for the current fiscal year is $1.26 billion. Of that, members contribute $819.5 million, which is about two-thirds of the normal cost. The state picks up the rest of the normal cost at $441.9 million. The cost of each member accruing another year of pension credit is a reasonable expense for the state.

However, the state’s only cost isn’t just the normal cost, but also a second payment toward the unfunded accrued actuarial liability. In fact, the state’s payment towards the unfunded liability is over 7.5 times the amount it is paying towards the normal cost.

The state’s payment would be significantly lower had the full payment been made in years past. This is because for each year the state does not make the full payment required by the actuaries, the unfunded liability increases. Again, this is akin to not making the full payment on your credit card—the minimum payment gets larger and larger.

The key benefits of being part of a defined benefit pension system

These are the reasons are why NJEA has fought, and will continue to fight, for the state to fully fund the pension.

- Provides a monthly retirement benefit for as long as you live.

- Amount you receive per month does not fluctuate with the stock market.

- Leaves all investment decisions to professionals.

- Is not overly costly to the taxpayer when funded properly.

The NJEA Pension Policy Committee

The NJEA Pension Policy Committee, which authored this article, studies and makes recommendations on problems and solutions relating to teacher retirement and other pension or benefit programs designed to help members and their dependents attain financial security upon retirement, disability, and/or death. It reviews legislative proposals related to changes in the Teachers’ Pension and Annuity Fund and the Public Employees’ Retirement System, and reviews actions of the respective pension systems’ boards of trustees.

The committee includes representatives from various county associations and NJREA.

- Bergen: Howard D. Lipoff, chair

- Atlantic: Karol E. Ball

- Camden: David M. Regn

- Gloucester: Michael Acchione

- Hudson: Mark C. Azzarello

- Hunterdon: Fiona Descala

- Mercer: Daniel A. Siegel

- Middlesex: Kenneth J. Veres

- Monmouth: Casey A. Barilka

- Morris: Kathleen L. Paterek

- NJREA: Irene Savicky

- Passaic: Pamela B. Fadden

- Somerset: Theresa Fuller

- Union: Linda A. Cortinas

- NJEA staff contact: Sarah Favinger

- NJEA associate staff contact: Roxie R. Mushin

Your pension benefit calculator

PERS members

nj.gov/treasury/pensions/pers-estimate.shtml

TPAF members: